“Wala ka na bang utang na loob?”

If you’ve ever heard this, you know how heavy it can feel. Like a slap made of words. It’s not just guilt — it’s cultural weight. It’s being told that no matter what you’re going through, you owe someone something. Usually money. Usually now. And here’s the thing: Utang na loob isn’t bad. It’s rooted in love, gratitude, and deep respect for the people who raised us, believed in us, or helped us survive. That’s beautiful. But when it comes to money, this beautiful value can quietly become a trap. Let’s talk about it — the emotional tug-of-war, the cultural expectations, and how to reclaim your power without betraying your values.

1. Obligation Shouldn’t Mean Self-Destruction

A lot of us were raised with the idea that we should “give back” the moment we can — sometimes even before we can. First job? Magpadala ka agad. Got a bonus? Ipalibre mo na yan. Started a business? Mag-invest ka sa negosyo ng pinsan mo kahit wala pa silang plano. It feels wrong to say no. But here’s the truth: you can’t give what you don’t have. If you’re constantly giving at the cost of your own stability, you’re not helping — you’re just postponing your own crash. And when that happens? You’ll have even less to offer the people you love. Think of it like this: if you’re drowning in financial pressure, you can’t pull others to shore. Sometimes, honoring people means building your strength first so you can actually support them in the long run.

2. There’s a Difference Between Gratitude and Guilt

Gratitude says: I see what you’ve done for me. I appreciate it. Guilt says: I owe you everything, forever. We confuse the two all the time. But only one of them is healthy. Utang na loob becomes toxic when it’s used as a leash — when people expect you to sacrifice your goals, your peace, or your bank account just to prove you care. That’s not love. That’s control. Here’s a mindset shift: Gratitude is best expressed through choice, not obligation. If you want to help someone financially, that’s powerful. But it should come from generosity, not guilt. Otherwise, you’re just feeding a cycle that drains both your wallet and your spirit.

3. You Can Redefine What “Giving Back” Looks Like

What if helping your family didn’t always mean handing over cash?

You can “give back” in so many ways: Helping a sibling learn budgeting so they don’t repeat financial mistakes Supporting a parent emotionally instead of financially during hard times Building a stable life so you break the cycle and future generations don’t go through the same struggle Even just being a good person, pursuing your dreams, and staying grounded — that’s a form of legacy, too.

We need to expand our definition of “utang na loob.” It’s not just about money. It’s about respect, care, and paying it forward in ways that don’t bankrupt you emotionally or financially.

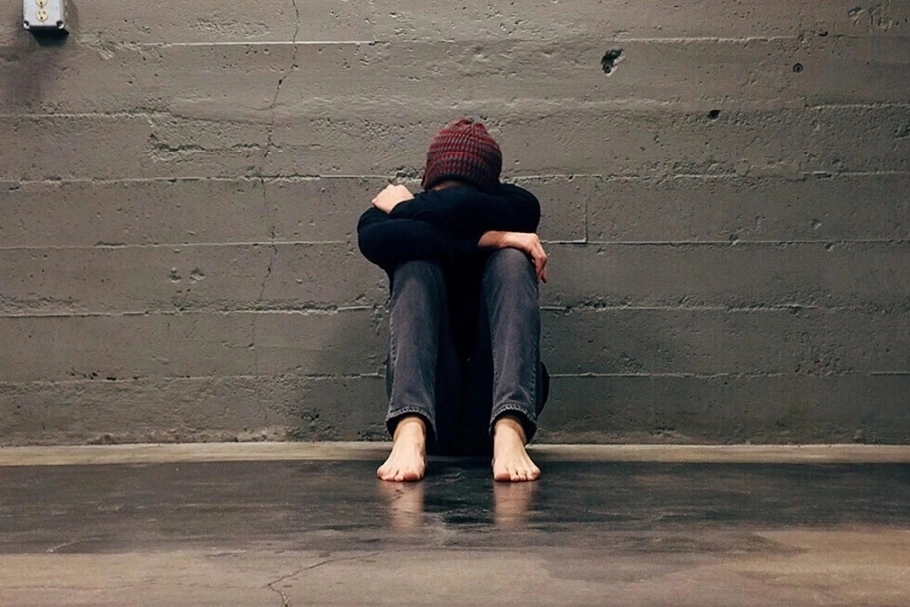

You Are Allowed to Choose Yourself

If this blog makes you uncomfortable, that’s okay. It means it’s touching something real. Culture is beautiful, but it should serve us — not control us. You can still love your family deeply and set healthy financial boundaries. You can still honor those who helped you without becoming financially stuck for life.

Choosing yourself doesn’t mean turning your back on others. It means standing tall so you can actually carry what matters most — your peace, your purpose, and your power.